Top 5 Press Brake Market Trends in 2024: Key Insights and Growth Opportunities

Table of Content

1. Press Brake Market Size & Growth

The global press brake market is projected to reach approximately $3.848 billion by 2024, with an estimated growth to $5.038 billion by 2031, reflecting a CAGR of 4.0%.

CNC press brakes are the core growth engine of the market. In 2023, global sales of CNC press brakes were $3.694 billion, expected to increase to $4.864 billion by 2030 (CAGR of 3.98%).

Regional Distribution: The Asia-Pacific region holds the largest market share at 54%, followed by Europe at 29% and North America at 21%.

2. Competitive Landscape of the Press Brake Market

High-End Market: Dominated by global players such as Trumpf (Germany), Bystronic (Switzerland), and Amada (Japan), who hold significant technological advantages.

Mid- to Low-End Market: Chinese brands account for 60% of the market share, with increasing penetration into high-end segments.

3. High-Growth Regions & Country Analysis

3.1Southeast Asia: Demand Surge Driven by Manufacturing Shift

Vietnam:

In 2024, China is expected to export over 670 press brakes to Vietnam (YoY +49.8%), valued at ¥124 million (YoY +56.7%), becoming China’s third-largest export market.

Driving Factors:

Industrial index growing by 7.2% annually (manufacturing +9.3%).

Surge in car sales (Q1 2025 YoY +24%).

Local production capacity is insufficient, relying on Chinese suppliers due to cost-effectiveness.

Thailand & Indonesia:

Benefiting from the shift of the electronics and home appliance industries, leading to strong demand for mid- to low-end press brakes.

3.2South Asia: India Leading Industrial Upgrade

India:

The core growth region in Asia-Pacific, with manufacturing policies like “Make in India” driving metalworking equipment imports.

The demand growth in the automotive and infrastructure sectors is exceeding regional averages.

3.3 China: The World’s Largest Single Market

2023 Market Size: ¥7.659 billion, expected to exceed ¥15 billion by 2025 and reach ¥30 billion by 2030 (CAGR 12-15%).

Growth Areas:

East China (Yangtze River Delta) manufacturing cluster, accounting for 45% of the market.

West and South China (industrial transfer, growth rate 15-18%).

Europe & North America: High-End & Green Technology Demand

North America: Manufacturing reshoring drives a CAGR of 6% (2024-2030).

Europe: Stricter environmental regulations are driving equipment upgrades, with a growth rate of 7% (urgent demand for low-energy hydraulic systems).

4. Press Brake Market Core Pain Points

4.1 Accuracy & Efficiency Bottlenecks

Traditional Equipment Deficiencies: Dependent on manual calibration, material rebound, and mold wear causing deviations, with tool change time exceeding 5 minutes per cycle.

Challenges in Processing Thick Materials: Bending copper strips thicker than 20mm can lead to angle deviations and surface damage, with scrap rates as high as 20%.

4.2 Insufficient Intelligence & Flexibility

72% of small and medium processing enterprises experience production failures due to equipment performance issues; 65% of capacity bottlenecks are related to low levels of automation.

Explosion in Small-Batch Orders: Traditional equipment has low mold change efficiency.

4.3 Cost & Service Delays

High-End Equipment Premiums: European and American brands’ 6-axis CNC press brakes are more than twice as expensive as domestic models.

Slow After-Sales Response: Cross-border maintenance response times can take up to 72 hours, impacting production line continuity.

5. Press Brake Technology Trends & Innovations

5.1 Flexibility & Automation Upgrades

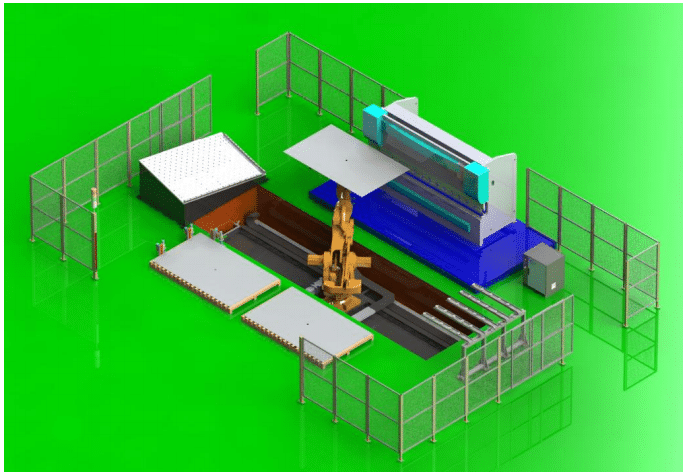

Flexible Bending Cell: A fully automated production system that typically includes a press brake, robot or automation handling system, workstations, and CNC systems. It is characterized by high automation and flexibility, allowing for quick adjustments based on different production needs and workpiece types.

Key Features:

Automation: Reduces manual labor and increases production efficiency by automating workpiece handling, positioning, and clamping.

High-Precision Bending: Ensures bending accuracy and consistency, equipped with high-precision CNC systems like the DA series.

Flexibility: Can handle different sizes and shapes of metal sheets, adjusting bending angles and process parameters as needed.

Reduced Downtime: Adjusts to different workpieces and production requirements without excessive manual intervention, reducing downtime and labor costs.

Small-Batch Production: Especially suited for small-batch and diverse production needs, able to quickly switch production modes and respond flexibly to changing market demands.

5.2 Tandem Press Brake

Consists of two CNC press brakes working in tandem, coordinated by the control system. The machines operate on the same workpiece simultaneously, completing more complex tasks through different bending angles or methods.

Tandem collaboration improves precision and speed, especially in large-area, complex shape workpiece processing.

5.3 Multi-Axis & All-Electric Drive

6-Axis CNC Press Brake:

Global market size in 2024: $62 million, expected to reach $100 million by 2031 (CAGR 6.3%), used in high-precision applications like automotive parts.

All-Electric Press Brake:

Uses motors and servo systems to drive the bending mechanics, entirely replacing hydraulic systems, reducing oil demand and pollution, with higher energy efficiency and environmental benefits.

In 2023, the global market size was approximately $1.2 billion, expected to reach $2.5 billion by 2032, with a CAGR of 8.5%.

Regional Share:

Asia-Pacific: Around 45% of the global market, benefiting from rapid manufacturing development in China, India, etc.

North America: Around 30%, driven by investment in high-end manufacturing and automation technologies.

Europe: Around 20%, with strong growth in precision manufacturing and eco-friendly policies.

LATAM, MEA: Around 5%, driven by modernizing manufacturing capacities and industrial automation investments.

5.4 IoT & Energy-Saving Technologies

Cloud Management Systems: Real-time production data monitoring and predictive maintenance to reduce downtime.

Electro-Hydraulic Servo Systems: Energy-saving by 30% compared to traditional hydraulic systems, becoming the mainstream in the Chinese market.